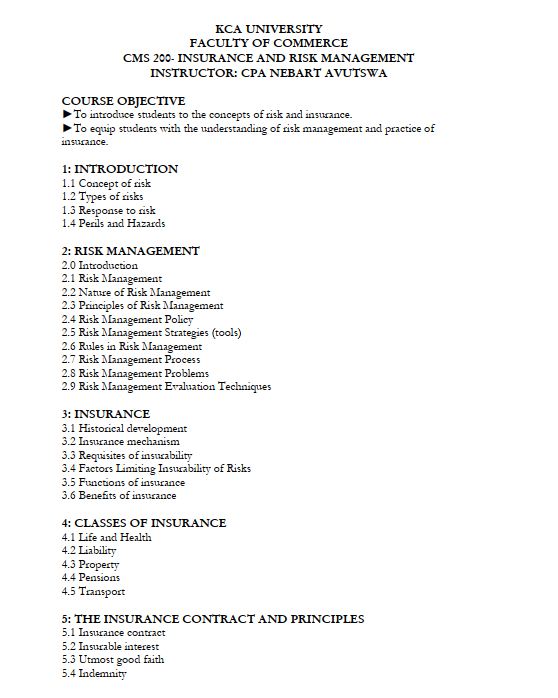

1: INTRODUCTION

1.1 Concept of risk

1.2 Types of risks

1.3 Response to risk

1.4 Perils and Hazards

2: RISK MANAGEMENT

2.0 Introduction

2.1 Risk Management

2.2 Nature of Risk Management

2.3 Principles of Risk Management

2.4 Risk Management Policy

2.5 Risk Management Strategies (tools)

2.6 Rules in Risk Management

2.7 Risk Management Process

2.8 Risk Management Problems

2.9 Risk Management Evaluation Techniques

3: INSURANCE

3.1 Historical development

3.2 Insurance mechanism

3.3 Requisites of insurability

3.4 Factors Limiting Insurability of Risks

3.5 Functions of insurance

3.6 Benefits of insurance

4: CLASSES OF INSURANCE

4.1 Life and Health

4.2 Liability

4.3 Property

4.4 Pensions

4.5 Transport

5: THE INSURANCE CONTRACT AND PRINCIPLES

5.1 Insurance contract

5.2 Insurable interest

5.3 Utmost good faith

5.4 Indemnity

5.5 Subrogation

5.6 Contribution

5.7 Proximate cause

6: INSURANCE PRACTICE

6.1 Proposal form

6.2 Policy document

6.3 Premiums

6.4 Renewals

6.5 Claims and disputes

6.6 Reinsurance

7: INSURANCE MARKETS

7.1 Buyers of Insurance

7.2 Intermediaries

7.3 Sellers and suppliers of Insurance

7.4 Problems of Marketing Insurance services.

7.5 Competition in the Insurance Industry

7.6 Alternative to Commercial Insurance

8.0 REGULATION OF INSURANCE SERVICES

8.1 Pre-Independence legislation

8.2 Post-Independence legislation

8.3 Objectives of Regulating Insurance services

8.4 Insurance Regulatory Authority