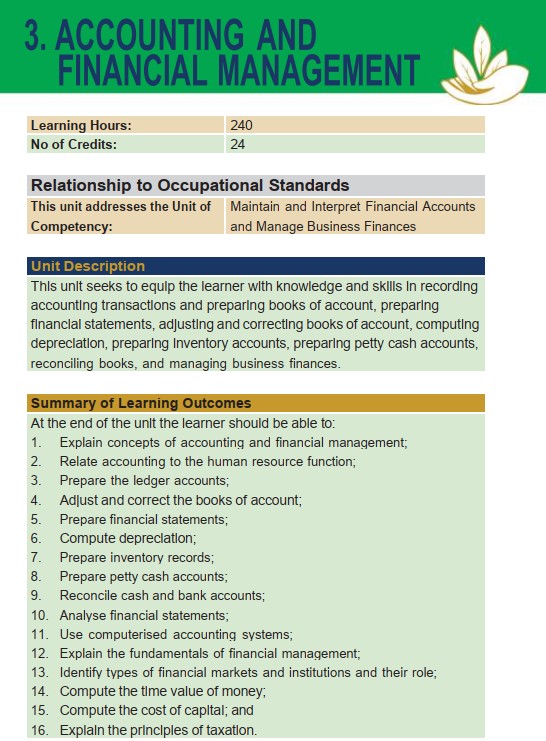

1. Explain the Concepts of Accounting and financial Management

1.1 Introduction to accounting and financial Management

1.2 Objectives of accounting and financial management

1.3 Accounting principles – Concepts and conventions

1.4 Accounting cycle

1.5 Accounting equation

1.6 Types of accounts

1.7 Book keeping systems

1.7.1 Single entry book keeping

1.7.2 Double entry book keeping

2. Relate Accounting to the Human Resource Function

2.1 Concepts of profitability, organisational sustainability and employee welfare

2.2 Users of financial statements and their needs

2.3 Impact of human resource costs on profitability

2.4 Link between the accounting and human resource functions

3. Prepare the Ledger Accounts

3.1 Introduction to the principles of bookkeeping

3.2 Journal entries

3.3 Ledger accounts

3.4 Trial balance extraction

4. Adjust and Correct the Books of Account

4.1 Identification and correction of errors

4.2 Adjustments for prepayments and accruals

4.3 Preparation of adjusted trial balance

4.4 Closing entries of the books of accounts

5. Prepare Financial statements

5.1 Preparation of financial statements for sole proprietors, partnerships, companies, non- profit making institutions

5.1.1 Income statement

5.1.2 Statement of financial position

5.1.3 Cashflow statement

5.1.4 Statement of changes in equity

6. Compute Depreciation

6.1 Concept of depreciation

6.2 Methods of depreciation;

6.2.1 Straight line

6.2.2 Reducing balance

6.2.3 Sum of years

6.2.4 Units of production

6.3 Accounting for depreciation in the income statement and statement of financial position

6.4 Impact of Depreciation on cash flow and income tax

7. Prepare Inventory Records

7.1 Inventory accounting systems

7.1.1 First in, last out

7.1.2 Average cost

7.1.3 Last in, first out

7.1.4 Periodic inventory systems

7.1.5 Perpetual inventory systems

7.2 Valuation of inventory

7.3 Accounting for inventory in financial statements

8. Prepare Petty Cash Accounts

8.1 Purpose of petty cash

8.2 Types of petty cash books: Columnar, imprest

8.3 Preparation of petty cash book

8.4 Controls on petty cash

9. Reconcile Cash and Bank Accounts

9.1 Importance of bank reconciliations

9.2 Process of preparing bank reconciliations; adjustments for various items

10. Analyse Financial Statements

10.1 Classification of accounting ratios

10.2 Importance of ratio analysis

10.3 Computation of ratios

10.4 Limitations of ratio analysis are explained

11. Use Computerised Accounting Systems

11.1 The role of computers in preparing financial accounts

11.2 Application and accounting softwares in the accounting process

11.3 The process of generating computerised accounts benefits and challenges of computerised accounting systems

Topic Content

12. Explain the Fundamentals of Financial Management 12.1 The nature and scope of finance

12.2 The relationship between accounting and finance

12.3 Role of a financial manager

12.4 Internal and external sources of business finance

13. Identify Types of Financial Markets and Institutions and their Role

13.1 Types of financial markets and institutions

13.2 Functions of financial markets

13.3 The flow of funds in financial systems

13.4 The role of the government in financial systems

14. Compute the Time Value of Money

14.1 The concept and relevance of time value of money

14.2 Discounting techniques

14.3 Payback period

14.4 Net present value

14.5 Internal rate of return

14.6 Loan amortisation schedules

15. Cost of Capital is Computed 15.1 The concept of cost of capital

15.2 Factors influencing the cost of capital

15.3 Computation of cost of capital for share capital, loan capital in small, non-complex entities

16. The Principles of taxation are Explained

16.1 Types of taxes

16.2 The process of computing taxes

16.2.1 Individual Income tax

16.2.2 Corporate tax

16.2.3 Value Added Tax

16.3 Tax reliefs

16.4 Tax remission

16.5 Offences and penalties